Middle East business aviation: a year in review

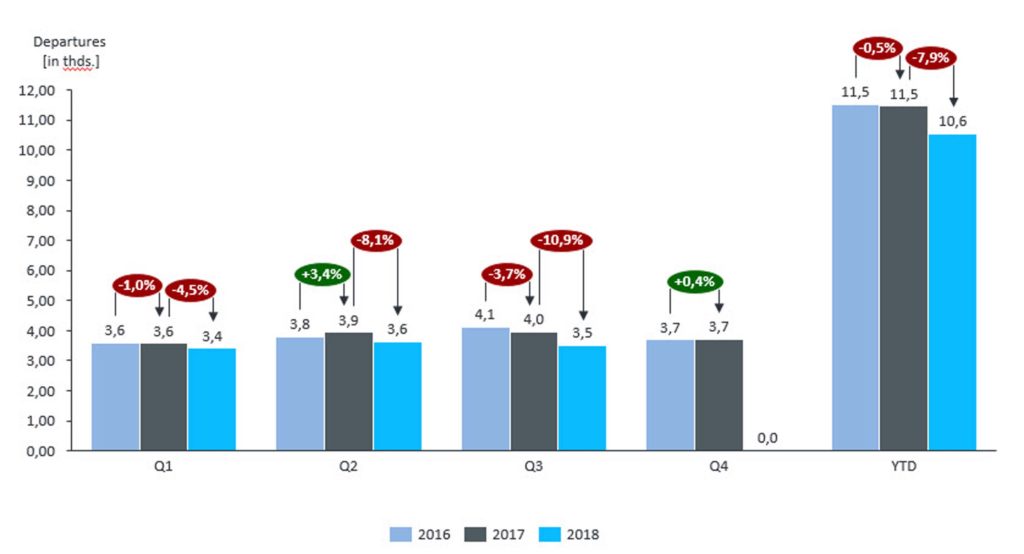

The resulting impact on business aviation activity from the Middle East in recent months is shown in Charts 1 and 2. Unsurprisingly, the trends are negative. Analysis of all outbound flights from the region indicates a 10.9% decline in comparable year-on-year departures during this summer, with the year-to-date trend down by 8%. The biggest impact has been felt in Privately-filed flight activity, with owner flights down by 16%. And across aircraft segments, by far the largest drop is in Bizliner traffic, with ACJ operations down by half in Q3-18.

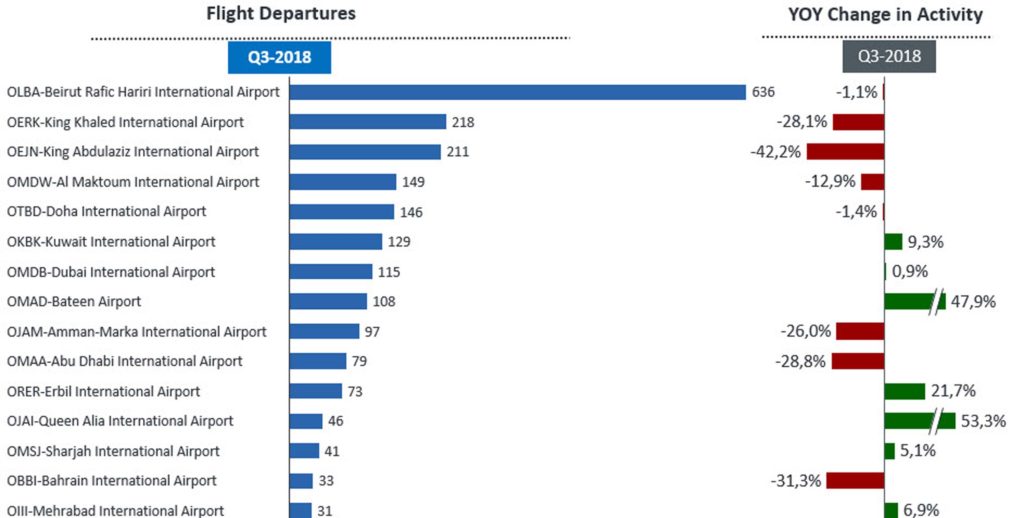

Chart 2 identifies which of the region´s airports have had the largest share of recent regional business aviation activity. Beirut Rafic Hariri International Airport (OLBA) is the busiest, with over 1,200 business jet movements in June, July and August 2018. Next busiest, King Khaled International Airport in Riyadh (OERK) and King Abdulaziz International Airport (OEJN) in Jeddah, have seen a big decline in traffic this summer. Dubai’s Al Maktoum International Airport (OMDW) is also down by more than 10% this summer. Kuwait International (OKBK) and Abu Dhabi’s Al Bateen (OMAD) led the growth locations in the third quarter of 2018.

Regional resilience

Notwithstanding the constraints on the region´s growth potential, business aviation still has a resilient user base in the Middle East. The fleet profile contrasts sharply with that of Europe and North America, with a disproportionately large share of heavy and long-range jets. This reflects both a relatively richer business jet owner, and the geographically remote scope of the region, underserved by an alternative transport network. Whereas the recession in Europe saw an elastic downturn in business jet usage, harder economic times in the Middle East have not seen many owners renounce their aircraft. Over 40% of all flights in the Middle East this year were operated by Bizliners, Ultra-Long Range Jets and Heavy Jets.

Currently the most acute constraints on business jet demand are political, rather than economic. Mainly this concerns Saudi Arabia. Prince Bin Salman´s reformist agenda has seen a clampdown on corruption, targeting many of the Kingdom´s high-ranking officials. The purge hit the headlines last year when a number of the accused were detained at the Riyadh Ritz Carlton, with their release conditional on handing over private assets, including business jets. Unsurprisingly, the corruption campaign has also encouraged other business jet owners to move their aircraft out of the country.

On the way, cyclical recovery in oil prices will bring back the petro-dollars and boost purchasing power across the Gulf. In short, the OEMs´ tilt towards large cabin jets entering the market in the next two years could yet pay off handsomely in the Middle East.

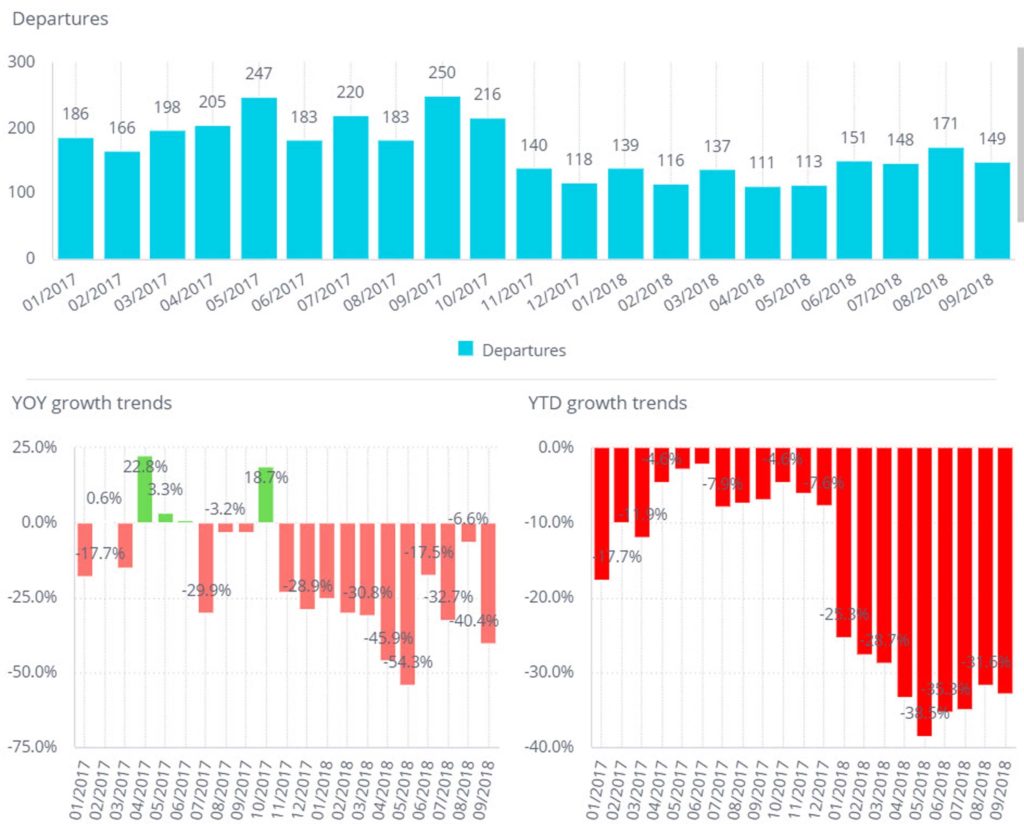

The combined effect of corruption crackdown and collapse in oil revenues has seen a substantial drop in the region´s leading business aviation market. The business jet fleet registered in Saudi Arabia declined by 10% in 2017 and may see a similar reduction this year. The repercussions from the recent Khashoggi affair may accelerate this decline, depending the extent to which Saudi Arabia suffers diplomatically and commercially, including sanctions on specific business jet owners and users. This has been reflected in falling business jet activity; year-to-date trends have been falling since 2016 and, as of September, flights from Saudi Arabia to Europe were down by more than 30%.

Other Gulf States´ business jet markets have fared little better. The UAE continues to be an important hub for business aviation, but new deliveries have stagnated as economic growth has slowed. Qatar is another Gulf State that is disappointing the business jet OEMs. Major ambitions to develop the sector, not least through Qatar Executive´s fleet of Gulfstream jets, have been frustrated by the country’s diplomatic isolation since last year. Other Gulf States such as Kuwait and Bahrain have seen business jet activity erode with the oil price.

Richard Koe is Managing Director of WingX Advance GmbH. WingX, based in Germany and founded in 2011, provides Business Intelligence for the global private jet market. WINGX researches and tracks market data, from which we build analytics to assist our customers in their decision making. Our customers span the entire industry supply chain, from airports, operators and manufacturers to industry investors and financial analysts. Richard has a background in sales, business development and strategy, in the business aviation sector and previously in telecom and manufacturing industries. He has a Batchelor degree from Oxford University and a Masters from Johns Hopkins University.

Some of the region´s peripheral countries, notably Israel, have maintained strong growth, while others such as Turkey have seen demand wither in the headwind of economic instability and political risk.

While there is little doubt the region´s business aviation sector contends with turbulent conditions in the near-term, longer-term investors may be more confident. The market is still immature, poorly regulated and under-resourced. There are significant efficiency gains to be made, and strong pent-up demand for local connectivity to be exploited. The Saudi regime´s much-vaunted reform programme will generate substantial international participation in infrastructure spending, and business aviation should be a beneficiary. On the way, cyclical recovery in oil prices will bring back the petro-dollars and boost purchasing power across the Gulf. In short, the OEMs´ tilt towards large cabin jets entering the market in the next two years could yet pay off handsomely in the Middle East.